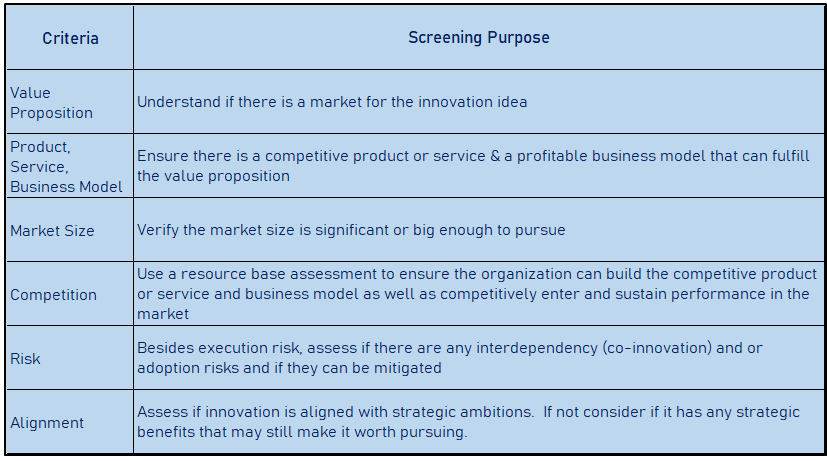

Many innovation projects fail due to lack of objective or rigorous screening of ideas at the beginning and at the various stages of concept development. To avoid these pitfalls, we have developed InnoScreen as comprehensive methodology (with scoring definitions and score action guides), that can be employed at an early stage (and at various stages) of the innovation process. The methodology helps to focus on six key areas right from the early stage of idea screening through to concept development and commercialisation. The focus areas and their screening purposes are;

At the bottom of this article, we have provided a free download link to a comprehensive workpack of InnStrat's InnoScreen, which organisations can use for innovation screening.

When used properly, InnoScreen helps to expose biased or weak assumptions, identify and mitigate risk and ultimately reveal the true potential of an innovation idea, to allow a decision to be made over whether to continue, put on hold or terminate its development. Where there is scope to proceed with the innovation project, the score action guide will provide pointers on areas to work on in order to validate assumptions, identify and contain risks. As the innovation project continues, the screening should be frequently revisited in order to update it with new and more accurate product, market and economic viability data about the concept development. This enables you to monitor your progress towards roll out of a competitive and economically viable business or uncover the need to stop and terminate the project.

For screening at the outset of an innovation project, the methodology can serve one of two purposes;

- Evaluate an idea independently and without comparison to other ideas.

- Evaluate competing ideas and use scoring system (weighted or non-weighted) to prioritise idea for development, where necessary.

For use case two, it is important that the scoring is used to compare similar types of innovation, such as Incremental vs Incremental. Comparing the scores of an Incremental Innovation to that of a Radical Innovation is an incorrect application of the methodology.

Using InnoScreen along with the scoring definitions and score action guide is highly intuitive. The screening should be done using a consensus approach. Ideally, the screening team should include the innovation team members and a member of organisation leadership as well as marketing function.

For a more detailed methodology on the application of InnoScreen, go for a Deep Dive below.

InnStrat's InnoScreen Deep Dive

InnoScreen is designed to prompt your development team and organisation’s senior leaders to think about the key factors that will determine the success or failure of an innovation project and whether the innovation is aligned with your strategic aims and brand reputation. To examine each of the six focus areas, screening questions are used to ensure the innovation idea is being thoroughly and objectively scrutinized.

At the end of the exercise, the answers to these questions will provide you with a clear indication as to the nature of the opportunity being pursued on the back of which you can make a decision regarding proceeding or terminating the project.

To use InnoScreen, your development team must be brought together to adopt a consensus style approach in answering each of the question. The final screening scores should not be derived using averaging approach.

The Team

Ideally, the team to carry out the analysis must be carefully selected to ensure that the screening exercise is not gamed to a biased outcome. This is a real possibility due to the fact that the screening team will consist of the innovation team, who in some cases, may have an attachment to the project and would like to see it proceed by all means. As such, in addition to the innovation development team, a member of the organisation leadership team in charge of your innovation efforts, as well as sales and marketing personnel and an outside facilitator (i.e. not a member of the innovation development team) should be employed to ensure the screening analyses are objective.

Advance Briefing

In advance of the screening workshop, the screening questions should ideally have been made available to the team. This will enable each team member to give the question some thought and bring some data (where applicable) as well as arguments for or against each question.

InnoScreen Workshop

The workshop must be run as an interactive one, with a facilitator that can moderate the time spent on each question. Each question must be allocated sufficient time to ensure it is properly evaluated and as much objectivity as possible has been provided.

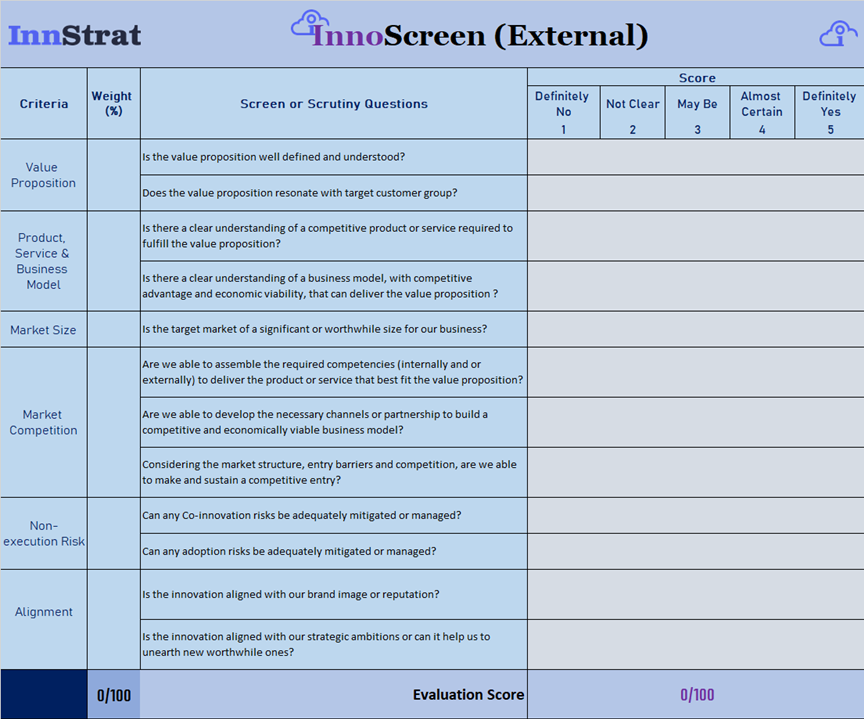

The InnoScreen scoresheet to use for scrutinizing the innovation and organization’s readiness to successfully commercialise is shown below.

Scoring

The questions should be answered on a continuum of definitely no to definitely yes, using the corresponding numbers as shown in the scoresheet

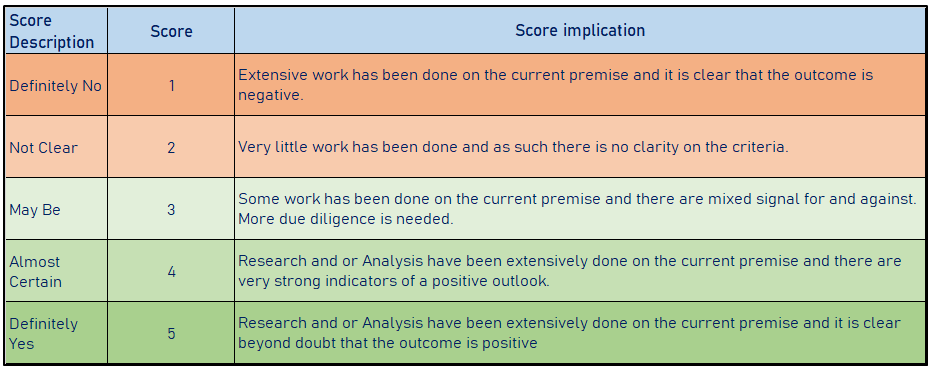

Before answering each screening question, the scoring implications should be known to the entire screening team. The below table outlines, in general, the state of play implied by each score;

When addressing the screening questions, the requirement for progression without further due diligence needed is to reach a consensus that the ranking to a question is either 4 or 5. A ranking of 2 or 3 should result in further research, analysis, business experiment, prototyping (as applicable) on the specific screening question, until it can be moved towards 4 or 5. Where a rating cannot be improved based on the current premise, the premise can either be revised (target customer group, narrowing or widening of value proposition, product features or specifications, business model option etc.) or there should be a consideration to either terminate the project or put the project on hold. Projects on hold in the development portfolio can be revisited at a later date when new information might be available (such as change in non-execution risks, paradigm shift in target market, technological breakthrough etc.).

A rating of 1 to majority of the questions should lead to consideration of stopping the project (as shown on the Score Action Guide). Alternatively, the premise of the initial assessment may be revised and the question reassessed. If a question cannot be moved away from a ranking of 1, it is advisable to stop the project.

The Score Action Guide provided in the workpack gives suggestions on actions to take based on the current score assigned to each screening question.

The purpose and required considerations of each criteria is provided below

Value Proposition

The importance of first and foremost assessing whether a value proposition (and consequently market) has been identified cannot be overstated. The value proposition should not only be defined, but should also be validated with a target customer group. This effectively ascertains whether a market exist or not. Many products or services fail due to lack of sufficient and objective market due diligence. As such, it is important to crystallize the value proposition, the target customer or market segment and understand the true need of the customer prior to defining the product or service to satisfy that need. This customer-centered ‘sense and respond’ approach; which finds the right products for your customer rather than search the right customers for your product will ensure you avoid costly technology push failures.

To establish the value proposition, the following must be considered;

Is there a value denial, job to be done or performance gap in the market? The value denial or performance gap could be in your own product or service or a competitor's own, which you can cannibalise. Also consider what changes can be made in the price-performance dimension of a product or service in order to convert current non-consumers to consumers. In addition to identifying this value proposition, it is also necessary to validate it, either through research information that is readily available or by carrying out your own market research within a target customer group.

This value proposition exercise, including its validation must be front and centre of your screening work early on. Even if the innovation is driven by a technological breakthrough of a new product or service, it is still important to go back to nail down and validate what value proposition it offers, before proceeding with design and development.

Product, Service & Business Model

When there is a need in the market (i.e. there is a validated value proposition), more often than not there will be more than one product or service that can fulfil that need. The aim of the screening questions here is to establish two key fundamentals;

Does your organization have a clear idea of a competitive product or service that will satisfy the need? Make sure to include a consideration of how the product or service will be positioned in the market. Will it be positioned based on price or performance, a combination of both or some other form of differentiation?

Does your organization have a clear idea of a business model that offers competitive advantage and economic viability (i.e. a profitable business) to capture the value in the innovation?

Typically for semi-radical or radical innovation, it may be sufficient to have a sketchy idea early on and this can be built on to obtain better definition as more engagement with the target market and supply chain occurs. Very quickly during concept development, critical features vs. nice to have features should be identified, so that an optimum specification can be nailed down. Also any restrictions; environmental, social or cultural sensitivities should be given due consideration.

Market Size

To know that customers exists for a value proposition is not enough to drive commercialisation investment decision. This criteria thus focus on the single point of size of the opportunity. The screening question here focuses on whether the estimated market size is sufficient for the organisation to pursue. The assessment should focus on if there are enough customers happy and willing to pay for this unmet need assuming the product or service is made available. Additionally, there must be consideration given to how many of those customers will be able to afford to pay at your determined market price.

For these factors, a good indication can be obtained from data of substitutes currently in the market, including the monetary value of the substitute market size. For entirely new value proposition, a direct market research of a sample of target customer should be considered.

Market Competition

After developing an idea of a competitive product or service and business model required to fulfill the value proposition, the capability to deliver into the market and sustain performance must be assessed.

Under this criteria, you need to assess if your organisation’s resources and competencies are adequate to deliver the competitive product or service.

You also need to assess if your organization can form the necessary partnerships or agreements required to build a competitive and profitable business model to capture the value of the innovation.

Additionally, it is important to assess the various elements of competition in the market (entry barrier, market structure, minimum entry scale, potential incumbent response, etc.) to ascertain if your organization can make and sustain a competitive entry.

Risk

Every innovation has an element of risk. Whilst a lot of risk exist in execution, which is wholly related to the organisation’s ability to deliver what has been envisioned and planned, other risks that are often over-looked and which are sometimes present and important are non-execution risks. It becomes critical to success when your value proposition depends on co-innovators to release certain products or services and or require other players in your value chain to adopt your offering before your value proposition can reach its target market. Under this criteria, the development team must focus on two main risk areas as identified by Ron Adner of Tuck Business School, Dartmouth College.

The first is the interdependency of the innovation on any other co-innovators, who might have to develop an infrastructure or utility to make it possible for your organisation’s innovation to be a success. An example that crystalize co-innovation risk is the first HDTV produced by Phillips in the 1980s. Despite Phillips success in execution and creating the HDTV, the high-definition cameras and transmission standards necessary to make HDTV work failed to arrive on time and Phillips ended up with a multibillion dollar innovation project that couldn’t deliver the expected returns as HD transmission and mass adoption did not arrive for another 20 years.

The second risk is related to the need for other parties in the value chain to adopt your innovation before it reaches the final consumer. An example that crystallize adoption risk is a company that developed a new generation of electrical switches and sensors that could dramatically reduce energy waste in buildings and deliver substantial savings to occupants. However, if these products require new major investment in training, upskilling and installation requirements, electricians and a host of other actors in building industry may refuse to adopt and offer these products to their clients. Under this circumstance, the value of these innovations would never be realized.

Innovation development teams must thus assess the likelihood of these risks in their innovation and plan appropriate mitigation and management, where possible. In some cases, an innovation may have to be put on hold if the co-innovation risks are too big to manage.

Strategic Alignment

Assuming the risk-reward profile of the opportunity is acceptable to your organisation, there still needs to be fit with your overall strategic aims. You need to assess if the opportunity makes strategic sense. To make this assessment, your screening team needs to consider the following

Will the opportunity contribute toward achieving any of your outlined strategic goals? Is it in line with your innovation strategy or is it likely to be a distraction that offers lower reward compared to those of your existing strategic ambitions? In effect, can it cause you to lose focus on your main and more valuable strategic goals within the competitive landscape or result in strategic drift?

If the opportunity is not strictly aligned with your strategic aims, you may still find it worthwhile if it can at least provide you a means of exploiting new business opportunities in your markets or perhaps in adjacent markets, considering those opportunities are anticipated to be just as valuable as those within your current strategic architecture.